On the stage in Charleston, S.C., Tuesday night stood one candidate who is running to be president — and six people running against the guy who is running to be president.

One by one, the Democratic candidates took shots at the self-described socialist who is suddenly the front-runner for the party’s presidential nomination.

“If you think the last four years has been chaotic, divisive, toxic, exhausting, imagine spending the better part of 2020 with Bernie Sanders versus Donald Trump,” said former South Bend, Ind., mayor Pete Buttigieg.

“Russia is helping you get elected,” former New York mayor Mike Bloomberg told Sanders, “so you will lose to [Trump].”

Businessman Tom Steyer told Sanders, “The answer is not for the government to take over the private sector.”

Former vice president Joe Biden pointed out that Sanders voted against an assault-weapons ban and in 2012 said "we should primary Barack Obama.”

Sen. Elizabeth Warren (Mass.) declared that she “would make a better president than Bernie.”

And Sen. Amy Klobuchar (Minn.) informed Sanders that his “math does not add up" and that “we should pay attention to where the voters of this country are, Bernie.”

Sanders scoffed, smirked, grimaced and glowered. “Not true!” he interjected, and “categorically incorrect!” He shook his head and waved his hand dismissively. “I’m hearing my name mentioned a little bit tonight — I wonder why,” the front-runner said.

He chose to parry by shouting counter-assaults — against Bloomberg, against Buttigieg, against Biden. The others joined in, and soon it was an all-out food fight, with rhetorical mashed potatoes landing everywhere. Warren hit Bloomberg, who hit Sanders. Biden hit Klobuchar, while Steyer hit Sanders and Bloomberg. Biden hit Steyer, and Warren pummeled Bloomberg.

Within the first few minutes, the CBS News moderators lost control. Candidates shouted at each other, talked over the moderators and interrupted at will. “He spoke over time, and I’m going to talk!” bellowed Biden. The audience cheered and booed as if watching professional wrestling.

The melee brought a sickening sense of deja vu.

After the South Carolina primary four years ago, on Feb. 22, 2016, I wrote:

“Are Republican voters really choosing as their standard-bearer a man who preaches such hatred and spews such vitriol?

“No, they aren’t — at least not yet. But they may get Trump anyway.

“The good news is that only 32.5 percent of South Carolina Republicans voted for Trump. The bad news: Trump may not need the support of a majority of Republican voters to secure the nomination.”

We now see a mirror image of this happening in the Democratic race. Sanders has only 29 percent support in polls, but the fragmented field prevents any one candidate from emerging as the alternative — much as the crowded field of Jeb Bush, Chris Christie, Marco Rubio, Ted Cruz and the rest split the anti-Trump vote in the Republican primaries.

If this field remains splintered, the Democrats will soon find it’s Sanders or nobody: Either Sanders wins the nomination outright or comes close enough that his angry supporters torpedo the nominee, assuring Trump’s victory. If Tuesday night’s dynamic holds, Democrats are on their way to opposing Trump with a 78-year-old socialist who recently suffered a heart attack, who has had nice things to say about nasty regimes around the word, and who has a $60 trillion spending plan without the means to pay for it.

Sanders’s opponents sounded the alarm.

“Not only is this a way to get Donald Trump reelected,” said Buttigieg. “We got a House to worry about. We got a Senate to worry about.”

Said Bloomberg: “If you keep on going, we will elect Bernie. Bernie will lose to Donald Trump. And Donald Trump and the House and the Senate and some of the statehouses will all go red.”

Yet the candidates couldn’t rise above their squabbles.

They vied to produce the best anti-Sanders barb. “Can anybody in this room imagine moderate Republicans going over and voting for him?” asked Bloomberg. Buttigieg accused Sanders of having “nostalgia for the revolution politics of the ’60s.”

But just as often the unfocused Democrats aimed their fire every which way. Warren took every opportunity to hammer away at Bloomberg, even using a question about Chinese manufacturing to denounce Bloomberg for failing to release his tax returns. She also invoked an allegation, denied by Bloomberg, that he once had told a pregnant employee to “kill it.”

The audience booed.

“If we spend the next four months tearing our party apart, we're going to watch Donald Trump spend the next four years tearing our country apart,” Klobuchar warned.

She’s right. The winner of Tuesday night’s debate was Trump.

Read more:

Many Democratic party actors seem content with a drawn-out contest — and not without reason.

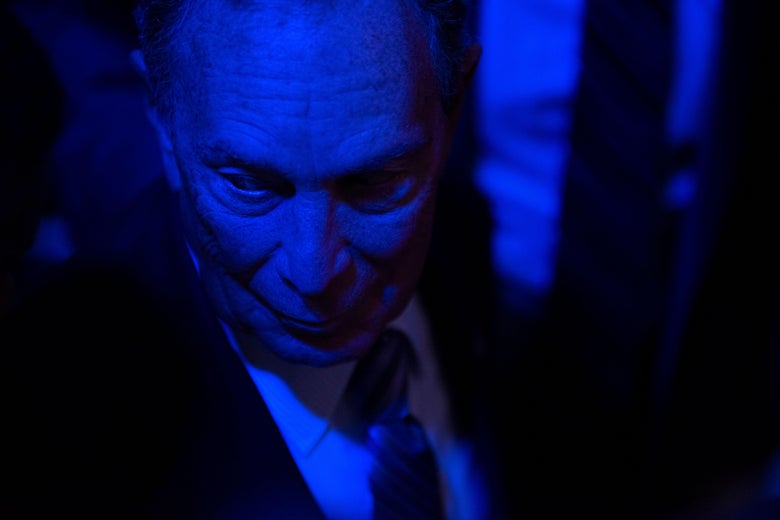

Photograph: Bloomberg

Get Jonathan Bernstein’s newsletter every morning in your inbox. Click here to subscribe.

With the Nevada caucuses coming up on Saturday, this is probably going to be the week that will finally bring some clarity to the Democratic presidential contest. Probably. We’ve already had chaos-maximizing results in Iowa, and then a New Hampshire primary which may have on balance added more chaos.

For the most part, this seems to be some combination of luck and circumstance (although the botched count in Iowa didn’t help, and that was just plain incompetence from the party). Just one example: Amy Klobuchar surged up to third place in New Hampshire, keeping her struggling campaign alive, thanks to a well-regarded performance in a debate that week. Had she instead done that well in the pre-Iowa debate, it’s likely that she would have done better there and perhaps ended Pete Buttigieg’s campaign (and perhaps even Elizabeth Warren’s). Or she might have had her usual debate results in New Hampshire (she’s typically done well, but not well enough to attract much notice) and she likely would have finished fifth in that state and dropped out of the race. Instead, five candidates with a plausible shot at the nomination contested Iowa, and the same five are all contesting Nevada.

Lots of people are saying that this is a sign of party weakness: Many party actors don’t want Bernie Sanders to win, but they’re failed to coordinate on a stop-Sanders candidate and therefore he may be the most likely candidate to win the nomination at this point.

Well … sort of.

The key is to think about this from the point of view of the party, and not the candidates. For the media and the campaigns, and for most voters, the nomination process is all about which candidate wins. But for the party, what’s more important is making sure that whichever nominee is chosen would govern as a partisan president — that he or she would be bound to the party’s policy positions and priorities and otherwise support the party from the White House. From that point of view, it just doesn’t matter that much which candidate wins, as long as that candidate wouldn’t undermine the party’s overall goals.

To be sure: Sanders remains a factional candidate, and yes, his nomination would be at least something of a sign of party weakness. That said, while some party actors clearly do oppose Sanders, others seem more ambivalent. Perhaps that’s because he’s been a fairly pragmatic senator. Or maybe they just don’t see him as all that far from the party on many key policy questions.

But what we’ve seen during Donald Trump’s presidency suggests that the parties have unrecognized strengths. Trump’s nomination was by far the clearest example of an outsider winning a presidential nomination over the objections of the bulk of party actors that has ever happened in U.S. history. And yet for the most part, Trump has wound up following the Republican party line in office. On tax cuts and judges, Trump’s record has been indistinguishable from what any of the Republican contenders in 2016 would have done. The same is basically true on health care and many other issues.

Only on trade and some foreign policy questions has Trump really strayed from party orthodoxy in important ways, and for the latter it’s not entirely clear what the party is thinking after Iraq anyway.

Now, perhaps some of this is just that Trump isn’t particularly interested in governing, something that would not be the case in a Bernie Sanders presidency. On the other hand, given that most of the more aggressive aspects of the Sanders legislative agenda are likely to fail in Congress, it’s not really clear how different an actual Sanders administration would be from a Biden or Warren or Klobuchar presidency.

And perhaps that — and not party weakness or incompetence — is why many Democratic party actors seem content to let things play out as they will in the primaries and caucuses.

None of this means that the nomination isn’t important. Some candidates will be better or worse at presidenting, which can have enormous consequences. They might be better or worse general election candidates. And the party itself shifts as a consequence of what happens in the nomination fight. But, at least to the extent that the parties are reasonably functional, it’s less of the life-or-death struggle that the candidates and their campaigns feel that it is and more incremental change — a bit more if one candidate wins, a bit less if another does.

(Disclaimer: Michael Bloomberg is also seeking the Democratic presidential nomination. He is the founder and majority owner of Bloomberg LP, the parent company of Bloomberg News.)

1. Matthew Dickinson on Richard Neustadt — and Donald Trump’s presidency.

2. Dave Hopkins still doesn’t see “lanes” in the Democratic presidential nomination contest.

3. Ruy Teixeira on turnout and a Bernie Sanders general election campaign.

4. Sarah Binder at the Monkey Cage on Congress, Trump and war powers.

5. And my Bloomberg Opinion colleague Francis Wilkinson on Trump’s false stories about voter fraud.

Get Early Returns every morning in your inbox. Click here to subscribe. Also subscribe to Bloomberg All Access and get much, much more. You’ll receive our unmatched global news coverage and two in-depth daily newsletters, the Bloomberg Open and the Bloomberg Close.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

To contact the author of this story:

Jonathan Bernstein at jbernstein62@bloomberg.net